The following are transactions of the Morrison Company:

a. On November 5, sold merchandise on account for $46,000 with terms of 3/15, n/30.

b. On November 20, payment was received on $32,000 worth of merchandise sold on November 5.

c. On December 5, further collections were made on $8,000 of merchandise sold on November 5.

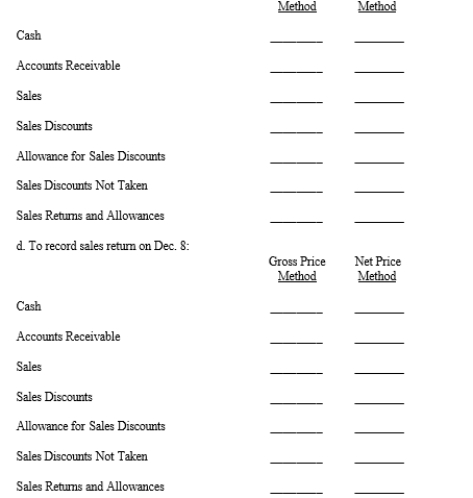

d. On December 8, merchandise sold for $4,000 on November 5 was returned by the purchaser and credit was granted by Morrison Company.

Required:

Consider the journal entry required for each transaction a-d. In the spaces below, record the appropriate dollar amounts to be debited or credited on the appropriate line for each account under the gross price and net price methods.. Indicate that the amount is a debit or credit by placing a Dr) or Cr) after the amount. Leave spaces blank for any accounts NOT affected by a transaction.

Correct Answer:

Verified

b. To re...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q132: In order to resolve its cash flow

Q133: Stacie, Inc. sold goods for $76,000 with

Q134: Based on the following information as of

Q135: Angler Fish Co. factored $540,000 of its

Q136: Caymen Supplies frequently assigns its accounts receivable

Q138: Bailey's Manufacturing Company is looking at changing

Q139: On December 1, the Harrison Company sold

Q140: On December 31, the Jacob, Inc. general

Q141: On September 1, 2013, Geco Co. sold

Q142: Prepare the journal entries for the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents