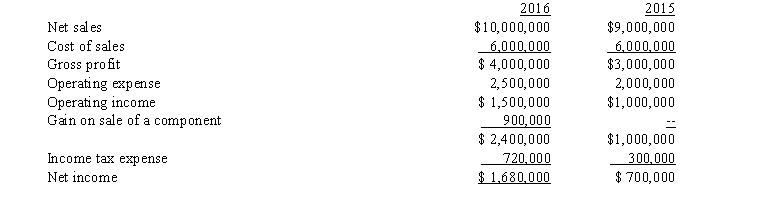

Exhibit 5-1

The following condensed income statement of Ranger Corporation is presented for the two years ended December 31, 2016 and 2015:  On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

2016 $700,000 loss

2015 $400,000 loss

Assume an income tax rate of 30%.

-Refer to Exhibit 5-1. In the preparation of a revised comparative income statement, Ranger should report under the caption "Discontinued Operations" for 2016 and 2015, respectively,

A) income of $140,000 and a loss of $280,000.

B) income of $140,000 and a loss of $0.

C) income of $200,000 and a loss of $400,000.

D) a loss of $700,000 and a loss of $400,000.

Correct Answer:

Verified

Q33: All of the following are included in

Q45: The subtotal, gross profit, will be disclosed

Q49: Gregory Company is disposing of a component

Q51: Intraperiod tax allocation requires a corporation's total

Q52: Which of the following would appear after

Q52: Which is least likely to be classified

Q54: Nelly Company sold its cattle ranching component

Q55: Which of the following is a required

Q56: Exhibit 5-1

The following condensed income statement

Q57: The gross profit of Larry Company for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents