Jim has been employed at Gold Key Realty at a salary of $2,000 per month during the past year. Because Jim is considered to be a top salesman, the manager of Gold Key is offering him one of three salary plans for the next year: (1) a 25% raise to $2,500 per month; (2) a base salary of $1,000 plus $600 per house sold; or, (3) a straight commission of $1,000 per house sold. Over the past year, Jim has sold up to 6 homes in a month.

a. Compute the monthly salary payoff table for Jim.

b. For this payoff table find Jim's optimal decision using: (1) the conservative approach, (2) minimax regret approach.

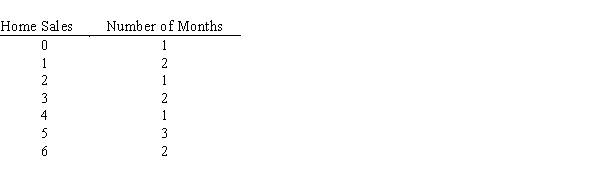

c. Suppose that during the past year the following is Jim's distribution of home sales. If one assumes that this a typical distribution for Jim's monthly sales, which salary plan should Jim select?

Correct Answer:

Verified

C.Use the relative frequ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: East West Distributing is in the process

Q71: The table shows both prospective profits and

Q72: When the utility function for a risk-neutral

Q73: A payoff table is given as

Q74: Dollar Department Stores has just acquired the

Q76: When the decision maker prefers a guaranteed

Q77: Fold back the decision tree and state

Q78: The Super Cola Company must decide whether

Q79: If p is the probability of Event

Q80: Lakewood Fashions must decide how many lots

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents