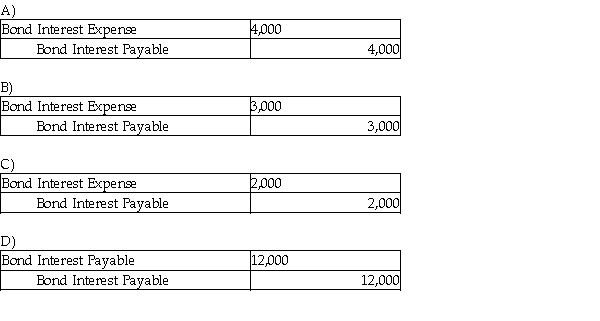

Bonds are issued for $100,000 at face value on September 1. The stated interest is 12% and interest is paid on September 1 and March 1. What is the adjusting entry on December 31? (Do not round any intermediate calculations. Round your final answer to the nearest dollar.)

Correct Answer:

Verified

Q19: A discount amortization does not affect the

Q90: James issued bonds for $30,000 at face

Q91: Bonds are issued for $80,000 at face

Q92: Bonds discount and bonds premium are expenses

Q93: When the amount received for the bond

Q95: When making the adjustment for accrued interest

Q96: Evans Corporation sells $400,000, 12%, 10-year bonds

Q97: Mansfield Corporation sells $900,000, 13%, 10-year bonds

Q98: At year end there was no accrual

Q99: Davis Corporation sells $200,000, 12%, 10-year bonds

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents