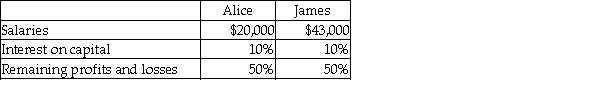

Alice and James are partners in a business. Alice's capital is $130,000 and James's capital is $170,000. Profits for the year are $130,000. They agree to share profits and losses as follows:  James's share of the profit is:

James's share of the profit is:

A) $52,000.

B) $65,000.

C) 39,000.

D) None of the above

Correct Answer:

Verified

Q44: The different partners are taxed on:

A) the

Q45: The basis on which profits and losses

Q46: A cash withdrawal of a partner was

Q47: Allison and Josh are partners in a

Q48: What is the closing entry to allocate

Q50: The net income earned by the Brian,

Q51: Applying the interest allowance method, compute Taylor

Q52: The original investment balances of partners Bridget

Q53: Partner B invested inventory using the retail

Q54: Partners Brian, Josh, and Chad have average

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents