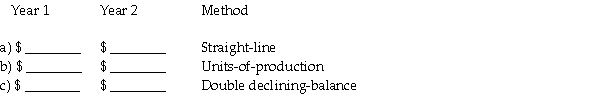

Bobson Company purchased a $60,000 machine on January 1. The machine is expected to have a useful life of 10 years or 60,000 operating hours and a residual value of $5,000. The machine was used for 6,000 hours in the first year and 4,400 hours in the second year. Compute the amount of depreciation expense for the first and second years under each of the methods below.

Correct Answer:

Verified

Q67: Budgeting for items such as equipment and

Q68: When equipment that is fully depreciated is

Q69: A company installed a new engine in

Q70: A loss on the sale of an

Q71: A piece of equipment is purchased for

Q73: What is the difference between an extraordinary

Q74: A gain on the sale of an

Q75: Capital expenditures would include:

A) additions.

B) betterments.

C) extraordinary

Q76: A company incorrectly records revenue expenditures as

Q77: A car is purchased for $30,000 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents