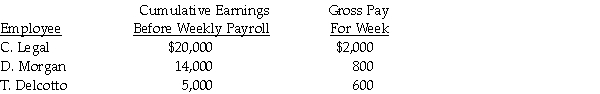

Record in the general journal the payroll tax entry for the week ended August 31. Use the following information gathered to make the entry.  a) FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

a) FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

b) Federal Unemployment is 0.8% on a limit of $7,000

c) State Unemployment is 2% on a limit of $7,000

Correct Answer:

Verified

Q19: When a business starts, what must it

Q20: A monthly depositor:

A) is an employer who

Q21: The payroll tax expense is recorded quarterly

Q22: Using the information below, determine the amount

Q23: The balance in the Wages and Salaries

Q25: A company must pay Form 941 taxes

Q26: A banking day is any day that

Q27: There is no limit on the amount

Q28: If Wages and Salaries Payable is debited,

Q29: Prepare a general journal payroll entry for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents