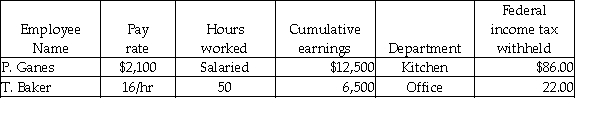

Grammy's Bakery had the following information for the pay period ending June 30:  Assume: FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

Assume: FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to FUTA Payable? (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

A) Debit $4

B) Credit $4

C) Debit $23

D) Credit $23

Correct Answer:

Verified

Q56: Why are all of the employer payroll

Q57: Form 941 taxes include OASDI, Medicare, and

Q58: The following data applies to the July

Q59: The following data applies to the July

Q60: The same deposit rules apply to employers

Q62: Information to prepare W-2 forms can be

Q63: The following data applies to the July

Q64: Which form is sent to the Social

Q65: A deposit must be made when filing

Q66: The following data applies to the July

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents