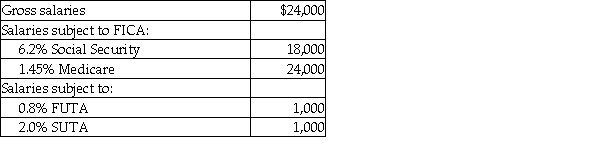

Bob's Cake House's payroll for April includes the following data:  The employer's payroll tax for the period would be: (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

The employer's payroll tax for the period would be: (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

A) $1,864.

B) $1,492.

C) $2,136.

D) $2,508.

Correct Answer:

Verified

Q97: Barbara's cumulative earnings before this pay period

Q98: Both employees and employers pay which of

Q99: A calendar quarter consists of:

A) 13 weeks.

B)

Q100: Bill's Auction House's payroll for June includes

Q101: Generally, employers can take a credit against

Q103: The federal government is responsible for administering

Q104: Which of the following taxes has a

Q105: The journal entry to record the estimated

Q106: As the Prepaid Workers' Compensation is recognized,

Q107: Payroll tax deductions are not expenses of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents