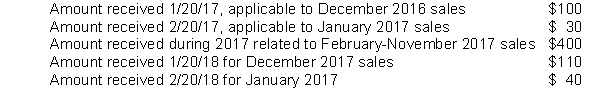

A city levies a 2 percent sales tax. Sales taxes must be remitted by the merchants to the City by the twentieth day of the month following the month in which the sale occurred. Cash received by the city related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/17?

A) $430.

B) $530.

C) $540.

D) $550.

Correct Answer:

Verified

Q26: Under GAAP, property taxes levied in one

Q27: GASB suggests that income tax revenues should

Q28: Under GAAP, property taxes levied in one

Q29: A city levies a 2 percent sales

Q30: Under the accrual basis of accounting, gains

Q32: During 2017, a state has the following

Q33: Under the modified accrual basis of accounting,

Q34: Gifts of capital assets are recorded in

Q35: A city that has property taxes of

Q36: During 2017, a state has the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents