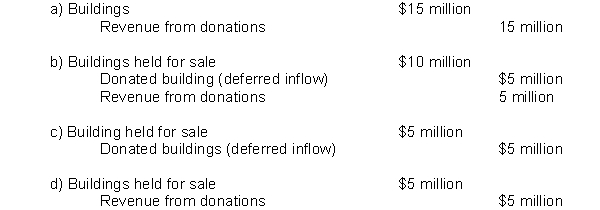

A wealthy philanthropist donates three buildings to H-Town. Each building has a fair market value of $5 million. The town plans to use Building 1 as a new fire station and sell Buildings 2 and 3. Building 2 is sold after year-end, but within the availability period. Building 3 fails to sell by the time the town issues the financial statements. Which of the following correctly records revenue from these donations in the governmental fund financial statements?

Correct Answer:

Verified

Q52: An anonymous benefactor has pledged to give

Q53: Reimbursement-type grant revenues are recognized in the

Q54: Payments made to a state pension plan

Q55: Last year a city received notice of

Q56: A city is the recipient of a

Q58: Unrestricted grant revenues with a time requirement

Q59: Which of the following are not characterized

Q60: A government is the recipient of a

Q61: The City of Kayla levies a local

Q62: Ben City maintains its books and records

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents