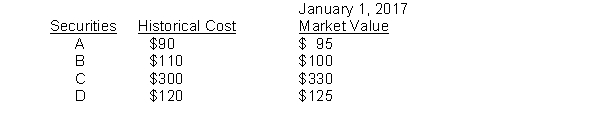

The City of Jolie maintains its books and records in a manner that facilitates the preparation of fund financial statements. Prepare all necessary journal entries to record the city's investment income and related transactions for the year 2017. The city has a 12/31 fiscal year-end. All of the City's investments are required to be reported at fair value. The beginning securities portfolio held by the general fund was as follows:  a.) Dividends received related to investments held in the general fund, $75.

a.) Dividends received related to investments held in the general fund, $75.

b.) On March 1, Security B is sold for $105.

c.) On April 1, Security E is purchased for $145

d.) On May 1 Security D is sold for $140.

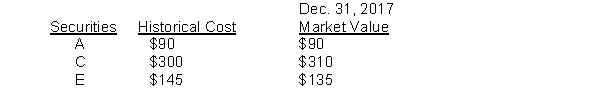

e.) On December 31, necessary adjusting entries are made to recognize appropriate amounts of gains/losses associated with the securities. The market values of the securities at year-end were as follows:

Correct Answer:

Verified

Q62: Ben City maintains its books and records

Q63: Governments use modified accrual accounting to determine

Q64: On December 30, 2016, a county purchases

Q65: A city receives a federal grant which

Q66: Paul City received payment of two grants

Q68: Castle County reported the following transactions during

Q69: In addition to exchange revenues, GASB standards

Q70: Answer the following questions with regard to

Q71: Answer the following questions with regard to

Q72: The City of Chessie received two contributions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents