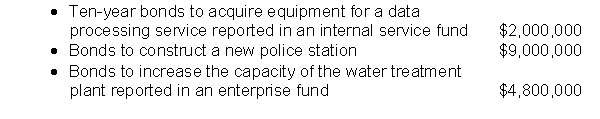

Kayla Township issued the following bonds during the year:  a. The amount of debt reported in the Township's general fund is:

a. The amount of debt reported in the Township's general fund is:

1. $0

2. $9,000,000

3. $11,000,000

4. $15,800,000

b. The township should report depreciation expense on related new capital assets in:

1. General fund

2. Enterprise fund

3. Enterprise and internal service funds

4. Capital projects fund

c. The bonds issued to construct the new police station should be reported as:

1. Debt proceeds in the general fund

2. Long-term debt in a debt service fund

3. Debt proceeds in a capital projects fund

4. None of the above

d. In accordance with bond covenants the township sets aside $1,000,000 to help ensure that it is able to meet its first payment of principal and interest on the police station debt due one year from the date the bonds were issued. The amount of liability that the township should report in its debt service fund is:

1. $0

2. $1,000,000

3. $9,000,000

4. $8,000,000

Correct Answer:

Verified

Q54: Which fund type would all governments normally

Q55: Lakeside Art Center, a nongovernmental not-for-profit entity,

Q56: The Chessie Foundation, a newly established governmental

Q57: Wigmore City receives a donation of $10

Q58: Which of the following is NOT included

Q60: Why do governments and not-for-profit entities use

Q61: What are the elements of the financial

Q62: The activities of an internal service fund

Q63: What are fiduciary funds? Why don't governments

Q64: The City of Orlando maintains funds for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents