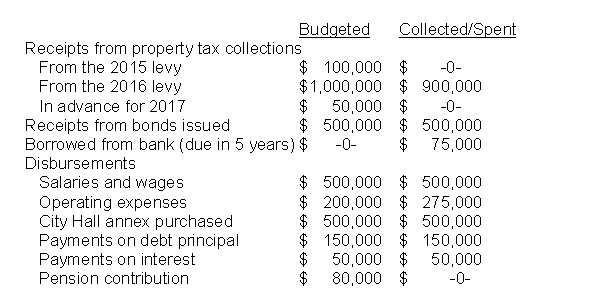

Thorn County adopted a cash budget for FY2016 as follows. The City budget laws prohibit budgeting or operating at a deficit. During the year the County collected or spent the following amounts. Was the County in compliance with budget laws? Did the County accomplish the goal of interperiod equity? Explain your answers in detail.  Explanations provided by the City for the differences between budget and actual are as follows. Property tax collections are down because the major industry in the community closed and many citizens are currently unemployed. Operating expenses are up because the only bridge over a river bisecting the City sustained damages by an uninsured motorist and had to be repaired immediately. The repair was not budgeted.

Explanations provided by the City for the differences between budget and actual are as follows. Property tax collections are down because the major industry in the community closed and many citizens are currently unemployed. Operating expenses are up because the only bridge over a river bisecting the City sustained damages by an uninsured motorist and had to be repaired immediately. The repair was not budgeted.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: In descending order, the hierarchy of GAAP

Q41: In the United States, educational services can

Q42: What are some of the definitional criteria

Q43: Save-the-Birds (STB), a not-for-profit entity dedicated to

Q44: Johnson City prepares its budget on the

Q46: What is the significance-for financial reporting purposes-of

Q47: Certain fiscal practices of governments promote interperiod

Q48: The Governmental Accounting Standards Board (GASB) stated

Q49: How does the FASB influence generally accepted

Q50: A not-for-profit entity raises funds to support

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents