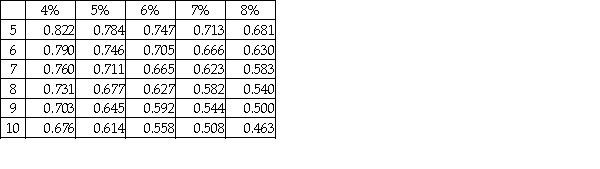

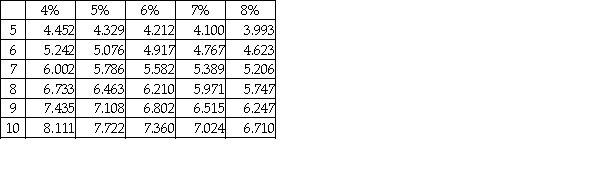

The face value of a bond is $75,000, its stated rate is 7%, and the term of the bond is five years. The bond pays interest semiannually. At the time of issue, the market rate is 8%. Determine the present value of the bonds at issuance. Present value of $1:  Present value of annuity of $1:

Present value of annuity of $1:

A) $53,709

B) $21,291

C) $71,991

D) $75,000

Correct Answer:

Verified

Q89: What is the difference between simple interest

Q163: Compute the present value of an ordinary

Q164: When using the effective-interest amortization method,the discount

Q170: The face value is $81,000, the stated

Q177: When using the effective-interest amortization method,the discount

Q179: If $32,000 is invested for one year

Q182: When using the effective-interest amortization method,the amount

Q183: Generally accepted accounting principles require that interest

Q186: Generally accepted accounting principles require that interest

Q200: When computing the present value of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents