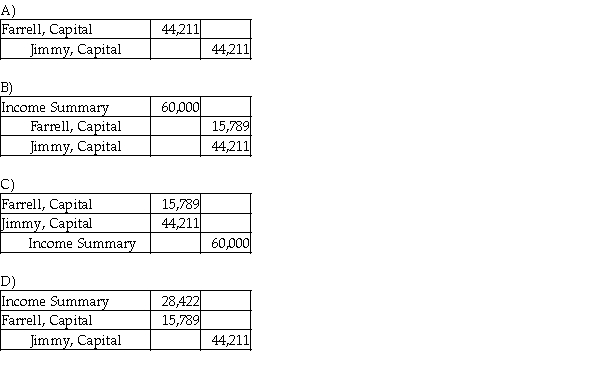

Farrell and Jimmy enter into a partnership agreement on May 1, 2017. Farrell contributes $50,000 and Jimmy contributes $140,000 as their capital contributions. They decide to share profits and losses in the ratio of their respective capital account balances. The net income for the year ended December 31, 2017 is $60,000. Which of the following is the correct journal entry to record the allocation of profit?

Correct Answer:

Verified

Q56: If a partner's capital account is credited

Q57: Profits and losses in a partnership must

Q58: Rodriguez and Ying start a partnership on

Q59: The balance sheet of Incrad Clothes, LLC,

Q64: David,Chris and John formed a partnership on

Q66: Albert,Billy,and Cathy share profits and losses of

Q70: Andre,Beau,and Caroline share profits and losses of

Q71: Farrell and Jimmy enter into a partnership

Q77: Alex,Brad,and Carl are partners.The profit and rule

Q80: The net income (loss)allocated to each partner

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents