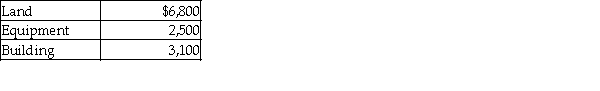

Hastings Corporation has purchased a group of assets for $21,900. The assets and their relative market values are listed below.  Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $4,133

B) $12,045

C) $4,380

D) $5,475

Correct Answer:

Verified

Q24: Safari Corporation has acquired a property that

Q29: Fred,Inc.owns a delivery truck.Which of the following

Q35: Ordinary repairs to plant assets are referred

Q36: Hawkeye Corporation has acquired a property that

Q41: A company purchased a computer on July

Q44: An asset is considered to be obsolete

Q47: An asset is considered to be obsolete

Q55: Which of the following depreciation methods allocates

Q59: The cost of an asset is $1,200,000,and

Q65: When a business uses the straight-line method

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents