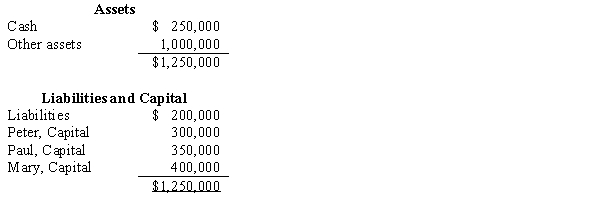

The partnership of Peter, Paul, and Mary share profits and losses in the ratio of 4:4:2, respectively. The partners voted to dissolve the partnership when its assets, liabilities, and capital were as follows:  The partnership will be liquidated over a prolonged period of time. As cash is available, it will be distributed to the partners. The first sale of noncash assets having a book value of $600,000 realized $475,000. How much cash should be distributed to each partner after this sale?

The partnership will be liquidated over a prolonged period of time. As cash is available, it will be distributed to the partners. The first sale of noncash assets having a book value of $600,000 realized $475,000. How much cash should be distributed to each partner after this sale?

A) Peter, $90,000; Paul, $140,000; Mary, $295,000

B) Peter, $210,000; Paul, $290,000; Mary, $145,000

C) Peter, $290,000; Paul, $210,000; Mary, $105,000

D) Peter, $150,000; Paul, $175,000; Mary, $200,000

Correct Answer:

Verified

Q5: Gilligan, Skipper, and Professor are partners with

Q6: An advance cash distribution plan is prepared:

A)

Q7: Offsetting a partner's loan balance against his

Q8: Which of the following statements is correct?

A)

Q9: The partnership of Mick, Keith, and Charlie

Q11: The partnership of Larry, Moe, and Curly

Q12: In an advance plan for installment distributions

Q13: The first step in preparing an advance

Q14: In a partnership liquidation the final cash

Q15: The summarized balances of the accounts of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents