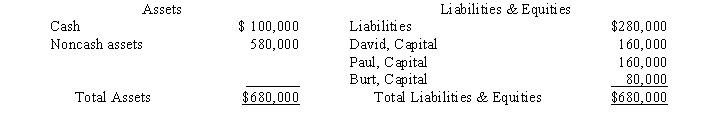

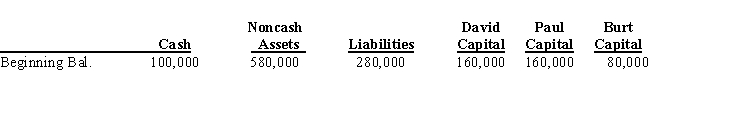

David, Paul, and Burt are partners in a CPA firm sharing profits and losses in a ratio of 2:2:3, respectively. Immediately prior to liquidation, the following balance sheet was prepared:  Required:

Required:

Assuming the noncash assets are sold for $160,000, determine the amount of cash to be distributed to each partner assuming all partners are personally solvent. Complete the worksheet and clearly indicate the amount of cash to be distributed to each partner in the spaces provided.

Correct Answer:

Verified

Q23: The Uniform Partnership Act specifies specific steps

Q24: The partnership of Homer, Marge, and Bart

Q25: The NOR Partnership is being liquidated. A

Q26: The trial balance for the ABC Partnership

Q27: An advance cash distribution plan specifies the

Q29: David, Paul, and Burt are partners in

Q30: The ABC partnership has the following capital

Q31: A trial balance for the DEF partnership

Q32: A, B, and C have capital balances

Q33: The summarized balances of the accounts of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents