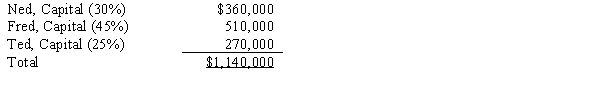

The partnership of Ned, Fred, and Ted had total capital of $1,140,000 on December 31, 2017, as follows:  Profit and loss sharing percentages are shown in parentheses. Assume that Ed became a partner by investing $300,000 in the Ned, Fred, and Ted partnership for a 25 percent interest in the capital and profits, and the partnership assets are revalued. Under this assumption:

Profit and loss sharing percentages are shown in parentheses. Assume that Ed became a partner by investing $300,000 in the Ned, Fred, and Ted partnership for a 25 percent interest in the capital and profits, and the partnership assets are revalued. Under this assumption:

A) Ted's capital credit will be $300,000.

B) Ned's capital will be increased to $394,000.

C) total partnership capital after Ed's admission to the partnership will be $1,200,000.

D) net assets of the partnership will increase by $380,000 including Ed's interest.

Correct Answer:

Verified

Q29: The partnership agreement of Sleeter, Frisco, and

Q30: The balance sheet for the partnership of

Q31: Donkey desires to purchase a one-fourth capital

Q32: The principal types of partnerships are general

Q33: Dante, Milton, and Cervantes formed a partnership

Q34: Mack and Ruben are partners operating an

Q36: Garlic, Pepper, and Salt are partners in

Q37: Carter and Gore are partners in an

Q38: There are two methods of recording changes

Q39: The following balance sheet information is for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents