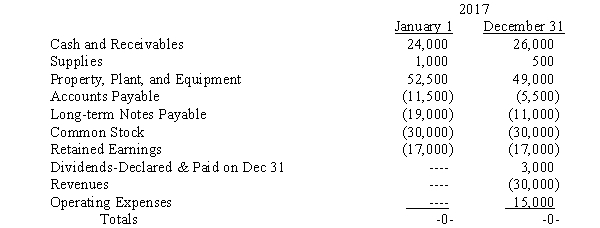

Dakota, Inc. owns a company that operates in France. Account balances in francs for the subsidiary are shown below:  Exchange rates for 2017 were as follows:

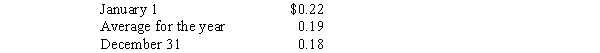

Exchange rates for 2017 were as follows:  Revenues were earned and operating expenses, except for depreciation and supplies used, were incurred evenly throughout the year. No purchases of supplies or plant assets were made during the year.

Revenues were earned and operating expenses, except for depreciation and supplies used, were incurred evenly throughout the year. No purchases of supplies or plant assets were made during the year.

Required:

A. Prepare a schedule to compute the translation adjustment for the year, assuming the subsidiary's functional currency is the franc.

B. Prepare a schedule to compute the translation gain or loss, assuming the subsidiary's functional currency is the U.S. dollar.

Correct Answer:

Verified

Q19: Under the temporal method, monetary assets and

Q20: The appropriate exchange rate for translating a

Q21: Use the information below to (a) translate

Q22: Accounts are listed below for a foreign

Q23: Stiff Sails Corporation, a U.S. company, operates

Q25: The translation process can be done using

Q26: Pike Corporation, a U.S. Company, formed a

Q27: Pike Corporation, a U.S. Company, formed a

Q28: On January 1, 2017, Roswell Systems, a

Q29: To accomplish the objectives of translation, two

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents