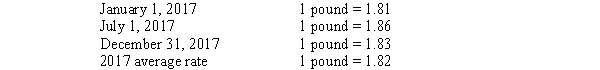

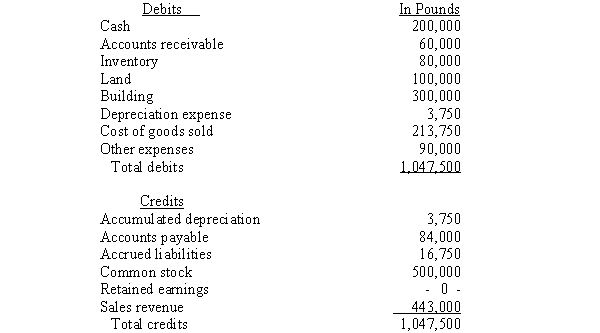

Pike Corporation, a U.S. Company, formed a subsidiary with a new company in London on January 1, 2017, by investing 500,000 British pounds in exchange for all of the subsidiary's common stock. The subsidiary purchased land for 100,000 pounds and a building for 300,000 pounds on July 1, 2017. The building is being depreciated over a 40-year life by the straight-line method. The inventory is valued on an average cost basis. The British pound is the subsidiary's functional currency and its reporting currency and has not experienced any abnormal inflation. Exchange rates for the pound on various dates were:  The subsidiary's adjusted trial balance is presented below for the year ended December 31, 2017.

The subsidiary's adjusted trial balance is presented below for the year ended December 31, 2017.  Required: Using the current rate method prepare the subsidiary's:

Required: Using the current rate method prepare the subsidiary's:

A. Translated workpapers (round to the nearest dollar)

B. Translated income statement

C. Translated balance sheet

Correct Answer:

Verified

Q19: Under the temporal method, monetary assets and

Q20: The appropriate exchange rate for translating a

Q21: Use the information below to (a) translate

Q22: Accounts are listed below for a foreign

Q23: Stiff Sails Corporation, a U.S. company, operates

Q24: Dakota, Inc. owns a company that operates

Q25: The translation process can be done using

Q27: Pike Corporation, a U.S. Company, formed a

Q28: On January 1, 2017, Roswell Systems, a

Q29: To accomplish the objectives of translation, two

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents