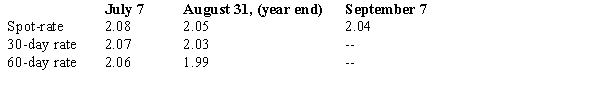

Madison Paving Company purchased equipment for 350,000 British pounds from a supplier in London on July 7, 2017. Payment in British pounds is due on Sept. 7, 2017. The exchange rates to purchase one pound is as follows:  On its August 31, 2017 income statement, what amount should Madison Paving report as a foreign exchange transaction gain:

On its August 31, 2017 income statement, what amount should Madison Paving report as a foreign exchange transaction gain:

A) $14,000.

B) $7,000.

C) $10,500.

D) $0.

Correct Answer:

Verified

Q1: The forward exchange rate quoted for the

Q3: With respect to disclosure requirements for fair

Q4: On September 1, 2017, Mudd Plating Company

Q5: A transaction gain or loss at the

Q6: The discount or premium on a forward

Q7: A transaction loss would result from:

A) an

Q8: From the viewpoint of a U.S. company,

Q9: On September 1, 2017, Mudd Plating Company

Q10: Greco, Inc. a U.S. corporation, bought machine

Q11: A discount or premium on a forward

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents