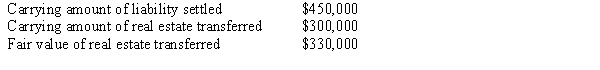

The following information pertains to the transfer of real estate in regards to a troubled debt restructuring by North Co. to Bell Co. in full settlement of North's liability to Bell:  What amount should Bell report as a gain or (loss) on restructuring?

What amount should Bell report as a gain or (loss) on restructuring?

A) $120,000 ordinary loss.

B) $120,000 extraordinary loss.

C) $150,000 ordinary loss.

D) $150,000 extraordinary loss.

Correct Answer:

Verified

Q3: In a troubled debt restructuring involving a

Q4: The final settlement with unsecured creditors is

Q5: A corporation that is unable to pay

Q6: When a bankruptcy court enters an "order

Q7: When a secured claim is not fully

Q9: The following information pertains to the transfer

Q10: Ford Corporation entered into a troubled debt

Q11: Splat Company filed a voluntary bankruptcy petition,

Q12: When a business becomes insolvent, it generally

Q13: Which of the following items is NOT

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents