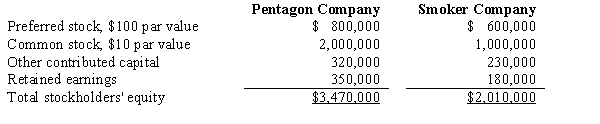

Pentagon Company acquired 90% of Smoker Company's common stock for $1,300,000 and 40% of its preferred stock for $300,000. On January 1, 2016, the date of acquisition, the companies reported the following account balances:  The preferred stock is 10%, cumulative, nonparticipating, and has a liquidation value equal to 102% of par value. Dividends were not paid during 2015. During 2016, Smoker Company reported net income of $200,000 and declared and paid cash dividends in the amount of $120,000. The difference between the implied value of the preferred stock and its book value is:

The preferred stock is 10%, cumulative, nonparticipating, and has a liquidation value equal to 102% of par value. Dividends were not paid during 2015. During 2016, Smoker Company reported net income of $200,000 and declared and paid cash dividends in the amount of $120,000. The difference between the implied value of the preferred stock and its book value is:

A) $60,000.

B) $78,000

C) $55,200.

D) $36,000.

Correct Answer:

Verified

Q17: Which of the following methods of allocating

Q18: Polish Company acquired 90% of Sandwich Company's

Q19: The constructive gain or loss to the

Q20: Pallet Corporation owns 90% of the outstanding

Q21: On January 2, 2016, Porous, Inc. acquired

Q23: Stemberger Company issued 10-year, 8% bonds with

Q24: On January 1, 2016, Pultey Company acquired

Q25: Parker Company owns 90% of the outstanding

Q26: Pentagon Company acquired 90% of Smoker Company's

Q27: Parker Company owns 90% of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents