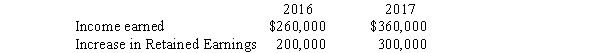

Pratt Company purchased 40,000 shares of Silas Company's common stock for $860,000 on January 1, 2016. At that time Silas Company had $500,000 of $10 par value common stock and $300,000 of retained earnings. Silas Company's income earned and increase in retained earnings during 2016 and 2017 were:  Silas Company income is earned evenly throughout the year.

Silas Company income is earned evenly throughout the year.

On September 1, 2017, Pratt Company sold on the open market, 12,000 shares of its Silas Company stock for $460,000. Any difference between cost and book value relates to Silas Company land. Pratt Company uses the cost method to account for its investment in Silas Company.

Required:

A. Compute Pratt Company's reported gain (loss) on the sale.

B. Prepare all consolidated statements workpaper eliminating entries for a workpaper on December 31, 2017.

Correct Answer:

Verified

Q16: If a parent company acquires additional shares

Q17: P Corporation purchased an 80% interest in

Q18: On January 1 2016, Paulus Company purchased

Q19: On January 1, 2012, Panda Company purchased

Q20: The computation of noncontrolling interest in net

Q22: On January 1, 2012, Pharma Company purchased

Q23: Poole made the following purchases of Smarte

Q24: Pamela Company acquired 80% of the outstanding

Q25: On January 1, 2016, P Corporation purchased

Q26: Pizza Company purchased Salt Company common stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents