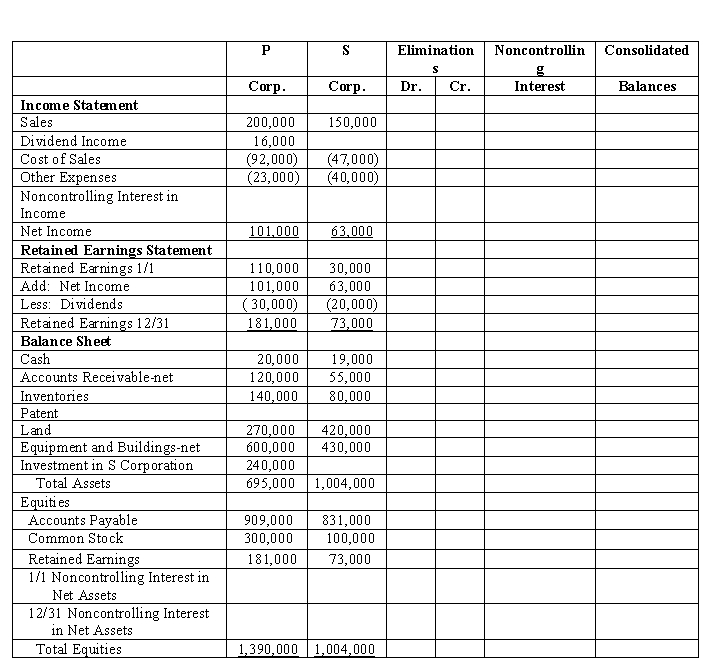

P Corporation acquired 80% of S Corporation on January 1, 2017 for $240,000 cash when S's stockholders' equity consisted of $100,000 of Common Stock and $30,000 of Retained Earnings. The difference between the price paid by P and the underlying equity acquired in S was allocated solely to a patent amortized over 10 years.

P sold merchandise to S during the year in the amount of $30,000. $10,000 worth of inventory is still on hand at the end of the year with an unrealized profit of $4,000. The separate company statements for P and S appear in the first two columns of the partially completed consolidated workpaper.

Required:

Complete the consolidated workpaper for P and S for the year 2017.

P Corporation and Subsidiary

Consolidated Statements Workpaper  December 31, 2017

December 31, 2017

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: P Company regularly sells merchandise to its

Q18: P Company sold merchandise costing $240,000 to

Q19: Polly, Inc. owns 80% of Saffron, Inc.

Q20: Noncontrolling interest in consolidated income is never

Q21: Puma Company owns 80% of the common

Q23: Poole Company owns a 90% interest in

Q24: P Company regularly sells merchandise to its

Q25: The following balances were taken from the

Q26: Pine Company owns an 80% interest in

Q27: P Company regularly sells merchandise to its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents