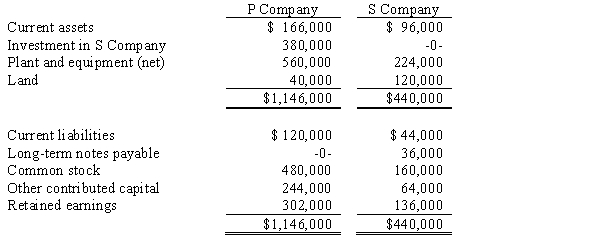

P Company purchased 80% of the outstanding common stock of S Company on January 2, 2016, for $380,000. Balance sheets for P Company and S Company immediately after the stock acquisition were as follows:  S Company owed P Company $16,000 on open account on the date of acquisition.

S Company owed P Company $16,000 on open account on the date of acquisition.

Required:

Prepare a consolidated balance sheet for P and S Companies on the date of acquisition. Any difference between the value implied by the purchase price of the investment and the book value of net assets acquired relates to subsidiary land. The book values of S Company's other assets and liabilities are equal to their fair values.

Correct Answer:

Verified

Q27: On January 2, 2016, Pope Company acquired

Q28: P Company acquired 54,000 shares of the

Q29: On January 1, 2016, Prima Corporation acquired

Q30: The primary beneficiary of a variable interest

Q31: IFRS defines control as:

A) the direct or

Q32: On December 31, 2016, Pinta Company purchased

Q34: On January 1, 2016, Pent Company and

Q35: A useful first step in the consolidating

Q36: There are several reasons why a company

Q37: On January 1, 2016, Pent Company and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents