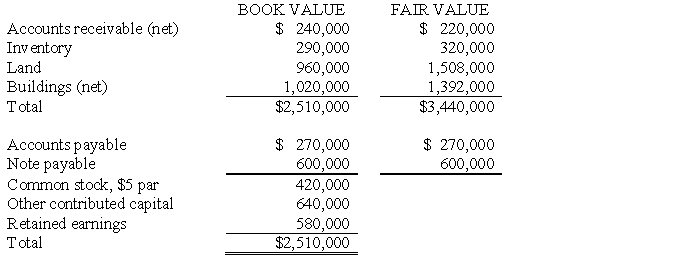

Edina Company acquired the assets (except cash) and assumed the liabilities of Burns Company on January 1, 2016, paying $2,600,000 cash. Immediately prior to the acquisition, Burns Company's balance sheet was as follows:  Edina Company agreed to pay Burns Company's former stockholders $200,000 cash in 2017 if post- combination earnings of the combined company reached $1,000,000 during 2016.

Edina Company agreed to pay Burns Company's former stockholders $200,000 cash in 2017 if post- combination earnings of the combined company reached $1,000,000 during 2016.

Required:

A. Prepare the journal entry necessary for Edina Company to record the acquisition on January 1, 2016. It is expected that the earnings target is likely to be met.

B. Prepare the journal entry necessary for Edina Company in 2017 assuming the earnings contingency was not met.

Correct Answer:

Verified

Q20: The first step in determining goodwill impairment

Q21: Condensed balance sheets for Rich Company and

Q22: If an impairment loss is recorded on

Q23: Balance sheet information for Hope Corporation at

Q24: Briefly describe the different treatment under SFAS

Q26: The fair value of net identifiable assets

Q27: Following its acquisition of the net assets

Q28: Posch Company issued 12,000 shares of its

Q29: Under SFAS 141R, what value of the

Q30: The stockholders' equities of Penn Corporation and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents