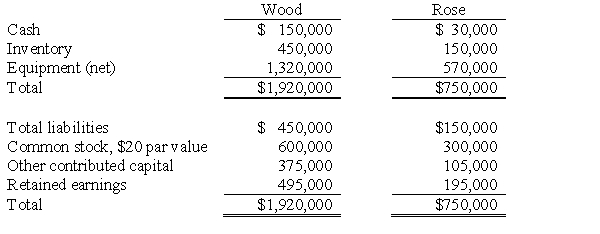

The following balance sheets were reported on January 1, 2016, for Wood Company and Rose Company:  Required:

Required:

Appraisals reveal that the inventory has a fair value $180,000, and the equipment has a current value of $615,000. The book value and fair value of liabilities are the same. Assuming that Wood Company wishes to acquire Rose for cash in an asset acquisition, determine the following cutoff amounts:

A. The purchase price above which Wood would record goodwill.

B. The purchase price at which Wood would record a $50,000 gain.

C. The purchase price below which Wood would obtain a "bargain."

D. The purchase price at which Wood would record $75,000 of goodwill.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Maplewood Corporation purchased the net assets of

Q33: The fair value of net identifiable assets

Q34: The managers of Savage Company own 10,000

Q35: SFAS No. 142 requires that goodwill impairment

Q36: Posch Company issued 12,000 shares of its

Q37: Porpoise Corporation acquired Sims Company through an

Q38: On May 1, 2016, the Phil Company

Q39: North Company issued 24,000 shares of its

Q40: P Company acquires all of the voting

Q41: On January 1, 2013, Brighton Company acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents