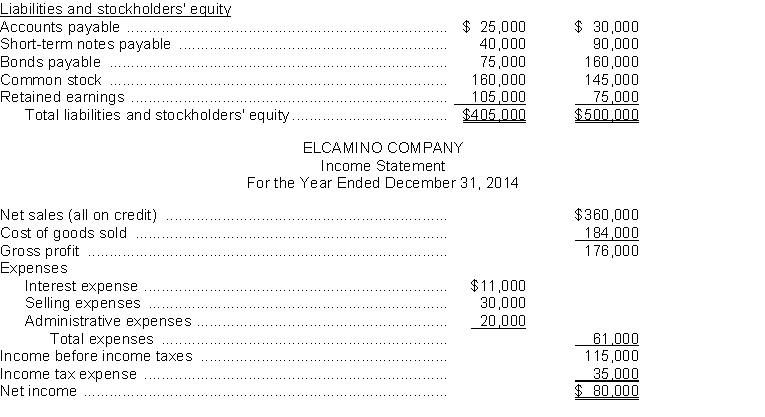

The financial statements of Elcamino Company appear below:

Additional information:

a. Cash dividends of $50,000 were declared and paid on common stock in 2014.

b. Weighted-average number of shares of common stock outstanding during 2014 was 50,000 shares.

c. Market value of common stock on December 31, 2014, was $16 per share.

d. Net cash provided by operating activities for 2014 was $70,000.

Instructions

Using the financial statements and additional information, compute the following ratios for the Lewis Company for 2012. Show all computations.

Computations

1. Current ratio_______

2. Return on common stockholders' equity

3. Price-earnings ratio________

4. Inventory turnover________

5. Accounts receivable turnover_______

6. Times interest earned_______

7. Profit margin________

8. Average days in inventory

9. Payout ratio_________

10. Return on assets________

11. Cash debt coverage______

Correct Answer:

Verified

2.

3. Price-earnings...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q243: _ analysis, also called trend analysis, is

Q245: Here is financial information for Valdez

Q246: The comparative balance sheet of Delta

Q247: Armada Company has these comparative balance

Q248: A change in depreciation methods during the

Q251: Here is the income statement for

Q252: The following information was taken from

Q253: Belcanto Corporation experienced a fire on

Q254: The following ratios have been computed

Q255: Operating data for Panola Land Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents