Multiple Choice

-The Social Security tax is considered to be a

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) marginal tax.

Correct Answer:

Verified

Related Questions

Q40: Assume a family that earns $20,000 pays

Q41: Jamal earns $160,000 per year and Josephina

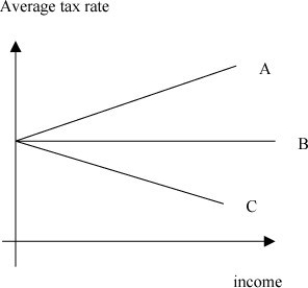

Q42: Q43: Jamal earns $160,000 per year and Josephina Q44: The marginal tax rate is Q46: Suppose you are making $50,000 per year Q47: Another name for a "flat-rate tax" in Q48: If a tax system is progressive, then![]()

A) the sum

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents