Use the following information for the next 4 questions.

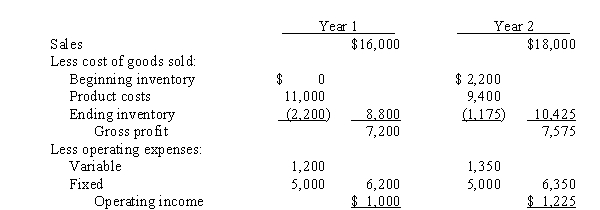

Bella, Inc. has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were:

-Operating income for year 1 using variable costing would be

A) $1,600

B) $(2,800)

C) $2,200

D) $400

Correct Answer:

Verified

Q34: Use the following information for the next

Q35: Compared to using absorption costing, using variable

Q36: Use the following information for the next

Q36: Direct materials costs are treated similarly under

Q37: Use the following information for the next

Q39: Ending inventory for year 2 using variable

Q40: Use the following information for the next

Q41: Use the following information for the next

Q42: In how many months would variable costing

Q43: Use the following information for the next

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents