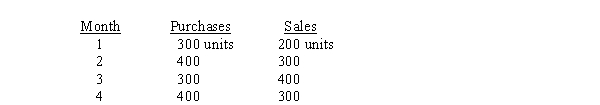

Use the following information for the next 2 questions.

Bynsel, Inc., a retailer, projects the following purchases and sales of its product for the next 4 months:  Each unit costs $100, and all purchases are on account. Two-thirds of purchases are paid in the month of the purchase and one-third are paid in the month following the purchase. Bynsel gets a 3% discount whenever it pays in the month of the purchase. The selling price per unit is $200. Sales are 60% cash and 40% on customer credit cards. The bank charges Bynsel a 5% fee for each credit card transaction and transfers the funds to Bynsel's checking account on the same day as the credit card sale.

Each unit costs $100, and all purchases are on account. Two-thirds of purchases are paid in the month of the purchase and one-third are paid in the month following the purchase. Bynsel gets a 3% discount whenever it pays in the month of the purchase. The selling price per unit is $200. Sales are 60% cash and 40% on customer credit cards. The bank charges Bynsel a 5% fee for each credit card transaction and transfers the funds to Bynsel's checking account on the same day as the credit card sale.

-What are cash disbursements for the third month?

A) $36,367

B) $23,033

C) $33,333

D) $32,733

Correct Answer:

Verified

Q103: Business strategy is incorporated in budgets through:

I.

Q105: Flexible budgets reflect:

I. Operations for actual costs

Q108: The budgeted income statement:

I. Accumulates information from

Q109: Activity based budgeting:

A) Is the same as

Q110: The cost of goods sold budget:

A) Includes

Q113: Budgets are used to:

I. Forecast future performance

II.

Q116: Rolling budgets:

I. Are often prepared monthly or

Q118: Expected ending inventory volumes and costs need

Q127: The difference between a static budget and

Q132: Use the following information for the next

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents