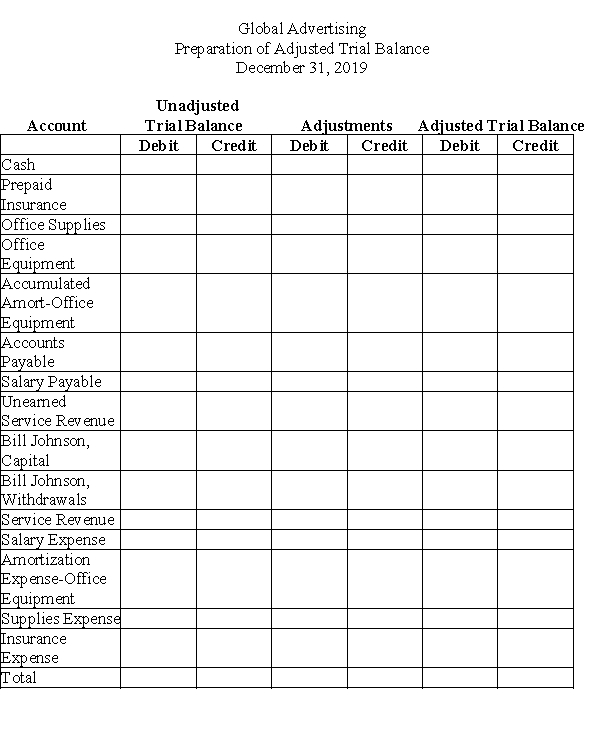

The following unadjusted account balances and adjustment data are for Global Advertising as of December 31, 2019: Adjustment data:

Office supplies on hand December 31, 2019, $500

Prepaid insurance expired during 2019, $275

Unearned service revenue, December 31, 2019, $1,500

Amortization on equipment for 2019, $2,800

Accrued salaries, $1,800

Fill in the trial balance, adjustments, and adjusted trial balance columns in the following table.

Correct Answer:

Verified

Q123: Companies reporting under IFRS and ASPE go

Q124: The heading of the income statement includes

Q125: The income statement should be prepared after

Q126: The use of IFRS for publicly accountable

Q127: IFRS specify that depreciation is the term

Q129: Companies reporting under IFRS and ASPE do

Q130: Table 3-6 Q131: The accounting guidelines for all countries recommend: Q132: The balance sheet reports the: Q133: Table 3-6

![]()

A)the

A)assets, equity, and

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents