During the audit of Keats Island Brewery for the fiscal year ended June 30, 2022, the auditors identified the following issues:

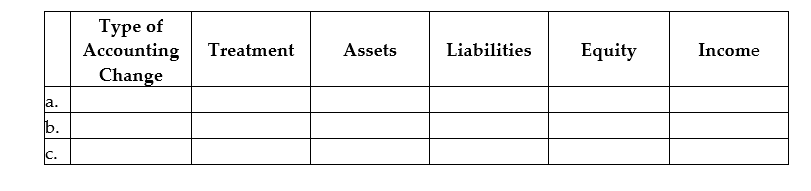

For each of the three issues described below, using the following table, identify both the direction (increase or decrease)and the amount of the effect relative to the amount without the accounting change.

a. The company sells beer for $1 each plus $0.10 deposit on each bottle. The deposit collected is payable to the provincial recycling agency. During 2021, the company had recorded $12,000 of deposits as revenue. The auditors believe this amount should have been recorded as a liability.

b. The company had been using the first-in, first-out cost flow assumption for its inventories. In fiscal 2022, management decided to switch to the weighted-average method. This change reduced inventory by $25,000 at June 30, 2021, and $40,000 at June 30, 2022.

c. The company has equipment costing $6,000,000 that it has been depreciating over 10 years on a straight-line basis. The depreciation for fiscal 2021 was $600,000 and accumulated depreciation on June 30, 2021, was $1,200,000. During 2022, management revises the estimate of useful life to 12 years, reducing the amount of depreciation to $480,000 per year.

Correct Answer:

Verified

Q29: Define the term "prospective adjustment." Which type

Q30: How should enterprises reflect changes in accounting

Q31: How many balance sheets are required by

Q32: Why is the prospective treatment conceptually appropriate

Q33: A retailer increases bad debts expense from

Q35: What types of accounting changes are treated

Q36: Albacore Sailboats manufactures small sailing dinghies. In

Q37: What are two reasons why an accounting

Q38: An analysis of a company's inventory indicates

Q39: For a construction contract where the company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents