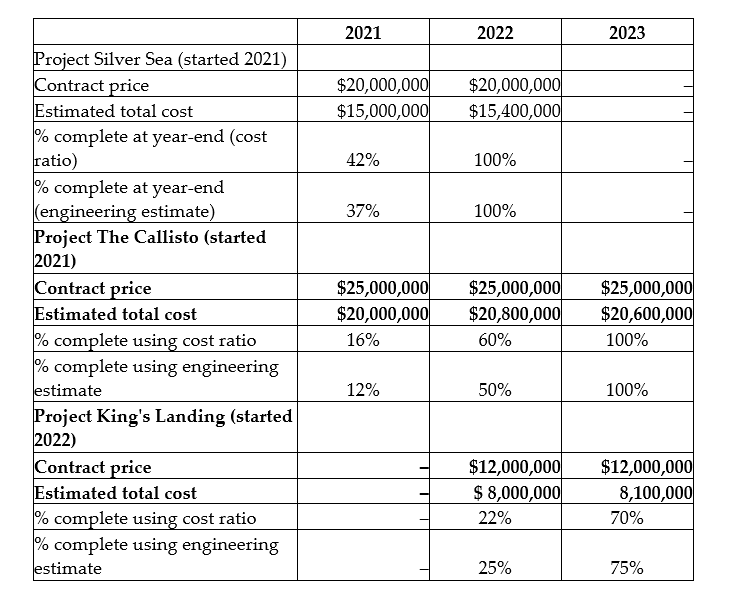

Sawatsky & Company Ltd is involved in the construction of top class luxury condos in Vancouver, Canada. Until the end of 2022, the company used the cost ratio method to estimate the percentage complete. After that point, the company switched to using estimates from architectural engineers to estimate the degree of completion. To prepare the financial report for the 2023 fiscal year, you have gathered the following data on projects that were in progress at the end of fiscal years 2021, 2022, and 2023:

Required:

a. Compute the amount of revenue and cost of sales that was recognized in 2021 and 2022 using the old accounting policy.

b. Compute the amount of revenue and cost of sales that should be recognized in each year using the new accounting policy.

c. Record the adjusting journal entries to adjust revenue to reflect the change in accounting policy from using the cost ratio to using engineering estimates. The general ledger accounts for 2023 have not yet been closed. Ignore income tax effects.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: The discussion in IAS 16 paragraphs 60-62

Q18: Which of the following statements is true?

A)A

Q19: For the following financial statement accounts, provide

Q20: For a company using the straight-line method

Q21: Which statement is true regarding accounting accruals?

A)Errors

Q23: For the following accounting changes, identify the

Q24: Why is the retrospective approach conceptually appropriate

Q25: Which statement is true regarding accounting accruals?

A)The

Q26: Give an example of a change in

Q27: Define "a retrospective adjustment."

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents