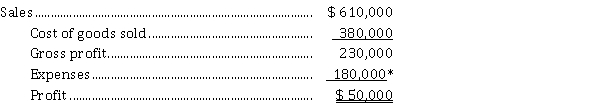

The income statement for Woodford Corporation for the year ended December 31, 2021 appears below:  *Includes $ 30,000 of interest expense and $ 16,000 of income tax expense.

*Includes $ 30,000 of interest expense and $ 16,000 of income tax expense.

Additional information:

1. The weighted average number of common shares issued on December 31, 2021 were 50,000 shares.

2. The market price of Woodford's shares was $ 18 at the end of 2021.

3. Cash dividends of $ 10,000 were paid, $ 6,000 of which were paid to preferred shareholders.

Instructions

a) Calculate the following ratios for 2021:

i. earnings per share

ii. price-earnings

iii. interest coverage

iv. total dividend payout

b) Comment on the above ratios, assuming the averages for the industry in which Woodford operates are as follows:

(i) earnings per share $ 1.20

(ii) price-earnings 10 times

(iii) interest coverage 2.2 times

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q162: The following information was taken from the

Q163: The balance sheets and income statements for

Q164: Selected information from the comparative financial statements

Q165: The balance sheet for Finley Corporation at

Q166: The following information is based on the

Q167: Certain information from the financial records of

Q168: The following ratios have been calculated

Q170: Winnipeg Corporation has issued common shares

Q171: The following selected ratios are available for

Q172: The following information for 2021 is provided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents