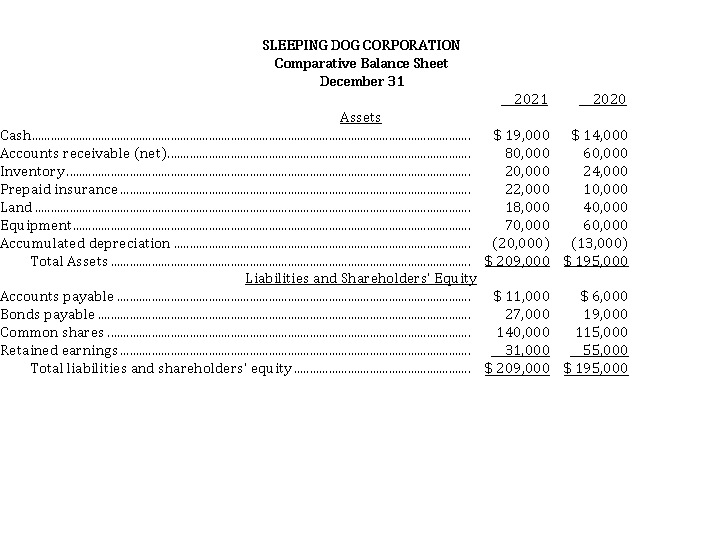

A comparative balance sheet for Sleeping Dog Corporation is presented below:  Additional information:

Additional information:

1. Loss for 2021 is $ 20,000.

2. Cash dividends of $ 4,000 were declared and paid in 2021.

3. Land was sold for cash at a loss of $ 10,000. This was the only land transaction during the year.

4. Equipment with a cost of $ 15,000 and accumulated depreciation of $ 10,000 was sold for $ 5,000 cash.

5. $ 12,000 of bonds were retired during the year at carrying value.

6. Equipment was acquired for common shares. The fair value of the equipment at the time of the exchange was $ 25,000.

Instructions

Prepare a cash flow statement for the year ended 2021, using the indirect method.

Correct Answer:

Verified

Q146: Tracks Holdings Ltd's comparative balance sheet at

Q147: The comparative balance sheets for Jellystone Park

Q148: The income statement of Stewart Limited is

Q149: Assuming a cash flow statement is prepared

Q150: The following information has been gathered by

Q152: Thunder Ltd. had total operating expenses of

Q153: The Fisheries Processing Corporation prepared the following

Q154: Selected transactions of Rudiment Inc., a public

Q155: The income statement of Meaney Inc. for

Q156: Fly Incorporated reported profit of $ 250,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents