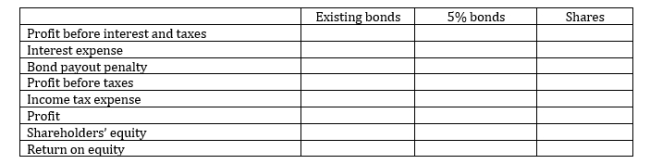

Southern Merchandising Inc. is considering new financing to pay out $ 2,500,000 of existing 10% bonds payable at the beginning of the next fiscal year. The company wants to maximize ROE in the new year. They are considering three alternatives of dealing with the matter:

1. Do not pay out the existing bonds;

2. Issue a 5% bond payable at face value of $ 2,500,000, or issue 250,000 common shares at $ 10.

Other information about Southern:

-Southern's tax rate is 25%.

-Southern currently has $ 4,000,000 in shareholders' equity prior to any new share issue.

-Southern's average profit before financing costs and taxes is $ 800,000.

-A one-time penalty of $ 150,000 will be incurred to pay out the 10% bonds early, which is fully tax deductible.

Instructions

Calculate the following amounts for Southern, compare all three alternatives, and make a recommendation, assuming the goal is to maximize return on equity for the next year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: On September 1, 2021, Imperial Corporation issued

Q16: On January 1, 2021, Golf Corporation issued

Q17: Swan Diver Inc. issued $ 400,000 of

Q18: Numbered Company Inc. issued $ 600,000, 6%,

Q19: On September 1, 2021, Guss Corporation issued

Q21: Millet Sales Corp., a public company, is

Q22: The following is a summarized balance sheet

Q23: Presented below are three different aircraft lease

Q24: Presented below are two independent situations:

a) On

Q25: Lance Corporation, a public corporation, entered into

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents