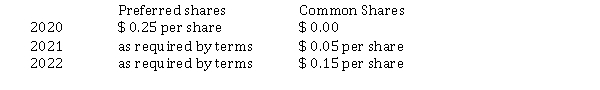

Trainor Corporation was organized on January 1, 2020. During its first year, the corporation issued 20,000 preferred shares with a $ 0.30 dividend entitlement and 200,000 common shares, both at $ 1 per share. At December 31, the corporation's year end, Trainor declared the following cash dividends:  Instructions

Instructions

a) Calculate the total dividends and the amount paid to each class of shares, assuming the preferred dividend is not cumulative.

b) Calculate the total dividends and the amount paid to each class of shares, assuming the preferred dividend is cumulative.

b).

c) Journalize the declaration of the cash dividend at December 31, 2022 using the assumption of part

Correct Answer:

Verified

Q181: Bancroft Holdings Inc. has authorized share capital

Q182: Checkered Rides Inc. has a March 31,

Q183: For the year ended August 31, 2021,

Q184: RD Holdings Ltd. which has authorized share

Q185: Solid Ltd. was incorporated on January 4,

Q187: Sawyer Corporation, a private company reporting under

Q188: Jogger Inc. is a private corporation reporting

Q189: Austrian Limited is a private corporation reporting

Q190: The trial balance of Terris Inc. for

Q191: KBR Investments Inc. has issued 90,000 Class

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents