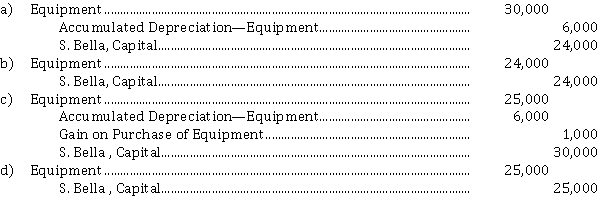

Stella Bella invests personally owned equipment, which originally cost $ 30,000 and has accumulated depreciation of $ 6,000, in the Bella and Duck partnership. Both partners agree that the fair value of the equipment was $ 25,000. The entry made by the partnership to record Bella's investment should be

Correct Answer:

Verified

Q32: The departing partner may have to pay

Q44: No capital deficiency means that all partners

Q46: A general partner in a limited partnership

A)

Q49: A bonus to a departing partner maybe

Q51: Limited partnerships

A) must have at least one

Q53: A bonus to the remaining partners may

Q64: In a limited liability partnership, a partner

Q64: There are three accounting issues where there

Q65: Which of the following is not an

Q70: Each partner's initial non-cash investment in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents