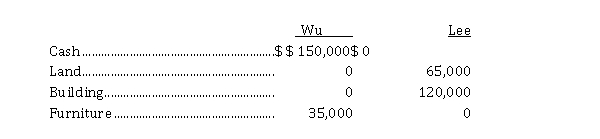

On January 1, 2020, Jacky Wu and Tim Lee decided to form a partnership, dividing all profits and losses equally and by making the following investments:  On December 31, 2020, the partnership reported a profit for the year of $ 28,000. On January 1, 2021, Wu and Lee agreed to accept Jody Smith into the partnership by purchasing 25% of partnership interest for $ 165,000 cash. The partnership agreement is amended to provide for the following sharing of profit and losses:

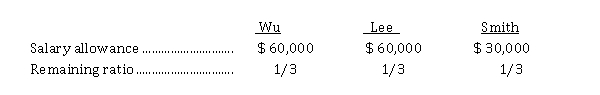

On December 31, 2020, the partnership reported a profit for the year of $ 28,000. On January 1, 2021, Wu and Lee agreed to accept Jody Smith into the partnership by purchasing 25% of partnership interest for $ 165,000 cash. The partnership agreement is amended to provide for the following sharing of profit and losses:  For the year ended December 31, 2021, profit was $ 330,000.

For the year ended December 31, 2021, profit was $ 330,000.

Instructions

a) Journalize the following transactions:

(1) the initial contributions to the partnership by Wu and Lee on January 1, 2020.

(2) the allocation of the profit to the partners at the end of December 2020.

(3) the purchase of the partnership interest by Smith on January 1, 2021.

b) Prepare a schedule to show the division of profit at December 31, 2021.

Correct Answer:

Verified

Q101: The liquidation of a partnership

A) cannot be

Q103: In the liquidation of a partnership, any

Q112: Partners A, B, and C have capital

Q139: The partners' profit and loss sharing ratio

Q140: Three types of partnerships were described in

Q142: Laroche, Kennedy, and White formed a partnership

Q144: Julie Harris, William Gosse, and Regina Ryan

Q145: At March 31, 2021, Mira Olynik and

Q146: Bob Spade and Ken Lundy have formed

Q149: Connie Knox and Andrea Cardoza have capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents