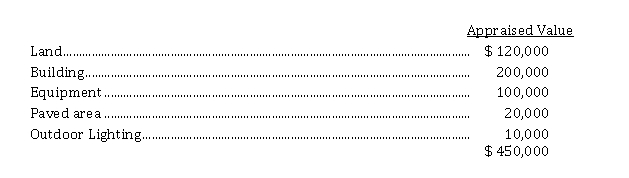

On May 5, 2021 Vermilion River Adventures purchased a property for $ 400,000 cash. The property included the following long-lived assets:  Instructions

Instructions

a) Give the journal entry to allocate the purchase price between the above assets. Round all amounts to the nearest dollar, if necessary.

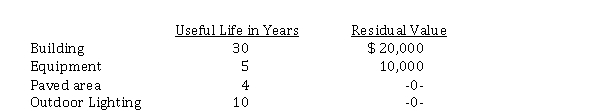

b) Prepare a compound journal entry to record depreciation of the long-lived assets on December 31, 2021, assuming the following additional details:

Prorate depreciation based on the number of months the asset has been in use.

Correct Answer:

Verified

Q226: On August 1, 2021, Mark Leamington Engineering

Q227: On March 31, 2021 Holland Industries purchased

Q228: Below are transactions for Oriel Company:

1. Purchased

Q229: The Northwood Clinic purchased a new surgical

Q230: Randy Automotive purchased equipment on October 1,

Q232: Das Gym purchased new equipment for $

Q233: Independent Energy depreciates all assets using the

Q234: Below are selected entries for Joanna Co.:

1.

Q235: Equipment acquired on October 1, 2021 at

Q236: Sangria Boat Lifts purchased equipment on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents