Use the following information for Questions

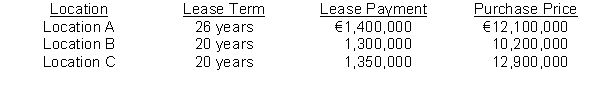

Yueve's Company is negotiating leases for three store locations.Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unknown (it is impracticable to determine) .

Each store will have a useful economic life of 30 years.Lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

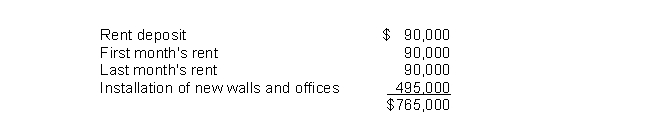

-On December 1, 2016, Goetz Corporation leased office space for 10 years at a monthly rental of $90,000.On that date Perez paid the landlord the following amounts:  The entire amount of $765,000 was charged to rent expense in 2016.What amount should Goetz have charged to expense for the year ended December 31, 2016?

The entire amount of $765,000 was charged to rent expense in 2016.What amount should Goetz have charged to expense for the year ended December 31, 2016?

A) $90,000

B) $94,125

C) $184,125

D) $495,000

Correct Answer:

Verified

Q21: In order to properly record a direct-financing

Q37: In the earlier years of a lease,

Q38: Which of the following is not an

Q40: The methods of accounting for a lease

Q41: Use the following information for Questions

Yueve's

Q43: Use the following information for Questions

Yueve's

Q44: Use the following information for Questions

Yueve's

Q45: A lessor with a sales-type lease involving

Q47: The initial direct costs of leasing

A)are generally

Q56: To avoid leased asset capitalization, companies can

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents