ABC Inc.'s Year 1 ending inventory was overstated by $20,000.Its Year 2 ending inventory was understated by $30,000.Assuming that the books for Year 2 are now closed, which of the following adjustments would be required? Assume a tax rate of 25%.

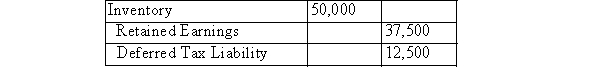

A) Please see the following table:

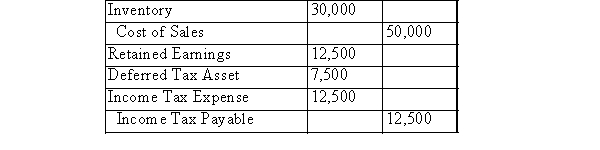

B) Please see the following table:

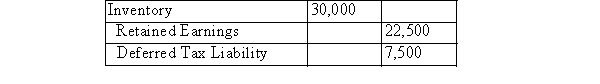

C) Please see the following table:

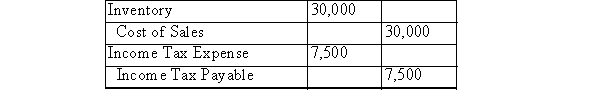

D) Please see the following table:

Correct Answer:

Verified

Q7: A plant asset was purchased for $19,000

Q8: The records of CTC reported rent expense

Q9: If the estimated useful life of an

Q10: An example of a special change in

Q11: In reporting the effect of an accounting

Q13: The errors listed below occurred in 20x3

Q14: Reported income for CXC was incorrect due

Q15: The following errors were discovered during January

Q16: A change in the salvage value of

Q17: Reported income during the early years of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents