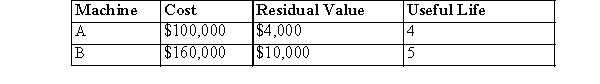

MMC changed depreciation methods from straight-line to sum-of-the-years'-digits on two of its machines.Data on the machines are as follows:  If MMC makes the change at the beginning of Year 2 of the life on each machine, what is the total amount of the catch-up adjustment for this change?

If MMC makes the change at the beginning of Year 2 of the life on each machine, what is the total amount of the catch-up adjustment for this change?

A) $56,000 debit to Accumulated depreciation

B) The effects of this change are accounted for prospectively; therefore, a catch-up adjustment is not recorded.

C) $34,400 debit to Accumulated depreciation

D) $34,400 credit to Accumulated depreciation

E) $34,400 credit to Retained earnings

Correct Answer:

Verified

Q22: At the end of Year 1, ABC

Q23: A change from the sum-of-the-years'-digits depreciation method

Q24: Which of the following is not an

Q25: Which of the following is not an

Q26: BVC began operations January 1, 20x1.Financial statements

Q28: On December 25, 20x2, JKL ordered merchandise

Q29: An asset that cost $66,000 was being

Q30: XYZ decided to change its depreciation policy

Q31: When a firm changes only the estimated

Q32: An asset that originally cost $6,000 is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents