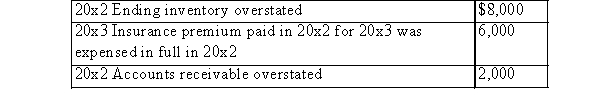

The following errors were discovered during January 20x3 (prior to any reversing entries) The accounting period ends December 31.  What effect did these errors have on the 20x2 pre-tax income?

What effect did these errors have on the 20x2 pre-tax income?

A) Understated by $1,000

B) Understated by $2,000

C) Overstated by $1,000

D) Overstated by $2,000

Correct Answer:

Verified

Q30: XYZ decided to change its depreciation policy

Q31: When a firm changes only the estimated

Q32: An asset that originally cost $6,000 is

Q33: The following accounting errors occurred in 20x3,

Q34: The primary principle addressed by recent changes

Q36: When an accounting change is to be

Q37: In 20x2, a firm changed from the

Q38: On January 1, Year 1, XYZ Inc.paid

Q39: At the end of the accounting year,

Q40: Under which of the following changes would

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents