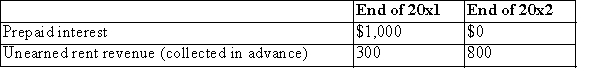

MGC Inc.reported $50,000 of net income for 20x2.The following deferrals and accruals were not recorded in the 20x1 and 20x2 adjusting entries:  MGC's correct 20x2 income was:

MGC's correct 20x2 income was:

A) $51,300

B) $49,300

C) $48,500

D) $50,500

Correct Answer:

Verified

Q50: A change from an accelerated depreciation method

Q51: The 20x4 net income of MXC Inc.was

Q52: On July 1, 20x1, PRC purchased a

Q53: The following errors were made in 20x3:

Q54: Choose the correct statement regarding accounting changes.

A)Income

Q56: Which of the following is not a

Q57: The concept of consistency is sacrificed in

Q58: The only errors BGC made were in

Q59: The effects for a change in accounting

Q60: Which of the following is an example

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents