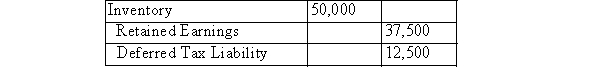

ABC Inc.'s Year 1 ending inventory was overstated by $20,000.Its Year 2 ending inventory was understated by $30,000.Assuming that the books for Year 2 are still open, which of the following adjustments would be required? Assume a tax rate of 25%.

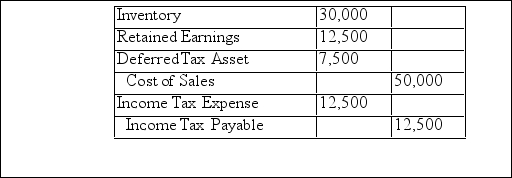

A) Please see the following table:

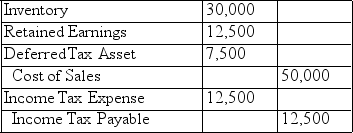

B) Please see the following table:

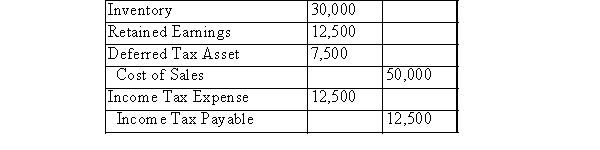

C) Please see the following table:

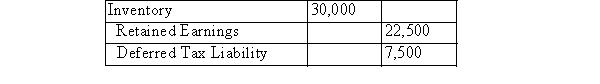

D) Please see the following table:

Correct Answer:

Verified

Q36: When an accounting change is to be

Q37: In 20x2, a firm changed from the

Q38: On January 1, Year 1, XYZ Inc.paid

Q39: At the end of the accounting year,

Q40: Under which of the following changes would

Q42: On January 1, Year 1, XYZ Inc.paid

Q43: Super-Mineral began operations last year (year 1)on

Q44: Which of the following statements is correct?

A)An

Q45: A company has been using straight-line depreciation

Q46: A change in the unit depletion rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents